FAQs on Health Insurance, Medicare Insurance, and Employee Benefits In Loveland, Longmont, Fort Collins, Windsor, Greeley, CO, and Surrounding Areas

If you’re healthy, you might wonder whether you really need health insurance. After all, you could simply pay for your medical needs as they arise and avoid paying a monthly premium, right? While technically true, the biggest advantage of having health insurance is to protect you from unexpected emergencies that can happen at any time. A fall on the ski slope, a broken leg, slipping on ice, appendicitis, or pneumonia requiring hospitalization—all of these scenarios can cost you a significant amount of money without insurance and could leave you burdened with medical debt for years.

In Colorado, the average cost for a hospital stay exceeds $2,400 per day, not including procedures, provider fees, x-rays, or other charges (based on a 2015 study). An emergency surgery could result in medical bills totaling tens of thousands of dollars. Health insurance, however, offers financial protection through its out-of-pocket maximum. For 2025, the maximum cost for self-only coverage is $9,200, and for family coverage, it is $18,200. This means that even if you require a $40,000 surgery, your out-of-pocket expenses would be capped at these amounts. While $9,200 or $18,200 is still a substantial amount, it provides significantly more security than facing the full cost without insurance.

Put simply, an HSA is a type of health insurance policy that allows you to open and deposit money into a savings account at the bank of your choice. You can then use the money you’ve saved on a tax-free basis for medical bills. Learn more about HSA plans here.

This depends on several factors. If your income falls within a certain range, you may qualify.

There are 3 main qualifications to receive a tax credit:

- Your income must fall within a certain range

- If you’re married, you must file a joint tax return

- You are not offered any group insurance, even if you’re not enrolled in it (there are a few exceptions to this rule)

The income that the system looks at is based on your Modified Adjusted Gross Income (MAGI) that is projected for the coming tax year. For some, this is simple, as your income is the same every month. However, if your income is variable or you are self-employed, it might be slightly more difficult to project that number going forward. We have a team of experts in our office ready to answer your questions about Tax Credits/subsidies and how they work into your health insurance plan.

If your only income is a normal paycheck from your employer, it will be your gross income on that check, multiplied out for the whole year. If you have income from other sources, such as alimony, rental income, or retirement income, that is also included. If your income is stable from year to year, the easiest way to calculate your MAGI is by using your most recent tax return.

Modified Adjusted Gross Income is basically your income before taxes are taken out, but after most Income included in MAGI (not an exhaustive list):

- Adjusted gross income from job or self-employment

- Rental income

- Dividends, IRA distributions, Pensions, Social Security income

- Unemployment, Alimony

- Some items that are deducted from your AGI (line 37) must be added back in to get your MAGI:

- Tax-exempt interest (line 8b)

- Non-taxable social security (line 20a)

- Untaxed foreign income

| Household Size (taxable household) | Minimum Yearly MAGI (projected for 2025) | Maximum Yearly MAGI* (projected for 2025) |

|---|---|---|

| 1 | $18,225 | $54,100 |

| 2 | $24,650 | $72,900 |

| 3 | $31,075 | $91,700 |

| 4 | $37,500 | $110,500 |

| 5 | $43,925 | $129,300 |

| 6 | $50,350 | $148,100 |

*Please note that there are some situations where income below this maximum still would not qualify for a tax credit. Contact us for more information.

If your income is less than the minimum listed in our MAGI chart, you will probably qualify for Health First Colorado, which is Colorado’s Medicaid program. The financial application is the same for Medicaid and for the Tax credit. You cannot qualify for both Medicaid and a Tax credit at the same time. Medicaid eligibility is calculated on a monthly basis, so if you recently lost your job and currently have no income, you could qualify for Medicaid until your situation changes.

Qualifying for Medicaid does not mean you can’t get traditional health insurance. Really, it just means you can’t get a tax credit. If you don’t qualify for a tax credit/subsidy, you can still apply for a regular plan during Open Enrollment or a Special Enrollment Period.

With most carriers, the insurance companies pay us a commission for each health policy we sell, which is already built into the premiums. However, Kaiser does not pay us for new individual policies written so we will have a separate charge directly to the insured member for our services. Charges may apply when choosing Kaiser.

Have you ever sat on hold with a company for hours, simply to ask why your payment didn’t pull out of your account? How about a 1 hour phone call just to change your address? Let’s not forget the frustrating feeling of hopelessness when you get transferred from department to department for the answer to a simple question! How many times have you used up your whole lunch break talking to an insurance company but not gotten anywhere? That’s where we can help! A broker (or agent) is your go-to when you have questions or concerns about your health insurance policy. We can find out the answer to your questions, and since we are local, you don’t have to wait on hold for hours to talk to us!

When you receive your renewal notice in the mail, you’re not necessarily stuck with that premium. We will help you shop for the best rate and best value so you know what options are out there. If you already have a policy in place, we would be happy to become your agent for the future! Contact us to find out how easy it is.

Contact us right away! You may have a special enrollment period. If you have another job already lined up and group insurance benefits starting with the new job, you might want to consider a Short Term gap insurance plan.

Yes! Your eligibility for COBRA doesn’t mean you have to take it. Often, you can get a better rate on the individual market than you can with COBRA. Before you elect COBRA, call us! Let us know your situation and we would be happy to run you a free quote and help analyze what’s best for you and your family.

Every year, there’s an Annual Open Enrollment period. You can definitely shop then. If it’s not Open Enrollment, you may be able to shop for a qualified plan if you have a Qualified Life Changing Event.

Open Enrollment happens at the end of each year. It is the only time of year that you can shop for new insurance or change your existing coverage without having a special Life Changing Event. If you don’t have insurance and you don’t have a Qualified Life Changing Event, then you’ll have to wait for the next open enrollment to get onto a plan. You can contact us anytime to determine whether or not you can get coverage now.

Outside of the annual Open Enrollment period, the only way to get qualifying insurance is to have a Qualifying Life Change Event (LCE). If you have one such event, you can get a Special Enrollment Period to shop for insurance. These SEPs only last for 60 days from the date of your event, so if you know you have a life change coming up, let us know so we can help you get ready for your enrollment period.

Some examples of SEPs:

- Getting Married

- Having a baby or adopting a child

- Losing your health benefits through your job (some limitations apply)

- Aging off your parents’ plan

- Moving to Colorado (some limitations apply)

- Others: Contact us to see if your event is a Qualified Life Change

Prescription costs:

Being a smart consumer can save you money. Prescriptions can be a really big part of your annual medical bills, especially if you’re taking a monthly medication. Your insurance may not be the best deal to get your prescriptions filled. If your plan has copays for prescriptions, those will often (but not always!) be a pretty good deal. But if you have an HSA plan or a plan without copays for prescriptions, the costs of medicines can be astounding! There’s a few resources out there for you, the consumer, to shop for the best deals for your particular prescription.

- Goodrx.com – search for the cash price for your prescription online. They often have coupons available that you can print out and use. Most of the time, if you use the coupon, you will not be able to credit that prescription cost towards your deductible.

- For high cost, brand name prescriptions (such as medications for MS), try going to the manufacturer’s website directly. Sometimes, they will have a copay assistance program available if you have regular health insurance. Sometimes, the assistance will even go towards your deductible!

Medical procedures:

- Did you know that the price of a specific procedure can vary greatly depending on which facility you visit? Before you schedule your MRI or blood tests, you may want to price the facilities within your insurance network to find out the best deal. Being a consumer will take some time and effort on your part, but could save you money in the long run.

- Health Care Blue Book – search for a procedure, test, or service based on your zip code. This tool can help you know what a fair price is in the area. The fair price is the amount that you should reasonably expect to pay in-network. It’s based on the local mix of prices, not the lowest price. That means some providers will be lower than the fair price. Once you get a fair price, you can call your doctor or facility and see where they fall on the price scale.

- Did you know that a standalone emergency room can cost much more than a traditional emergency room? Urgent care centers can save you money as well, if you aren’t having a life-threatening emergency.

In contrast, however, a standalone facility for procedures like lab work, imaging, or testing can cost you significantly less than that same procedure at a hospital. We’ve put together a few comparisons for you for common procedures at two different facilities:

| Colonoscopy with Biopsy | Estimated Cost* |

|---|---|

| Stand alone imaging facility | $1,400-$1,700 |

| Hospital | $3,700-$4,200 |

*Estimates only – your costs may vary. May not include physician or facility fees, etc

| X Ray of Ankle | Estimated Cost* |

|---|---|

| Stand alone imaging facility | $50 |

| Hospital | $330 |

*Estimates only – your costs may vary. May not include physician or facility fees, etc

Different hospitals can vary significantly for the same that they provide. There are many reasons for this, but it may be worth your time to call the hospitals in your area to find out an estimated cost for your planned procedure, such as childbirth:

| Normal Vaginal Childbirth | Estimated Cost* |

|---|---|

| Hospital A | $10,700 |

| Hospital B | $15,200 |

*Estimates only – your costs may vary. May not include physician or facility fees, etc

| Normal C Section Childbirth | Estimated Cost* |

|---|---|

| Hospital A | $15,000 |

| Hospital B | $22,800 |

*Estimates only – your costs may vary. May not include physician or facility fees, etc

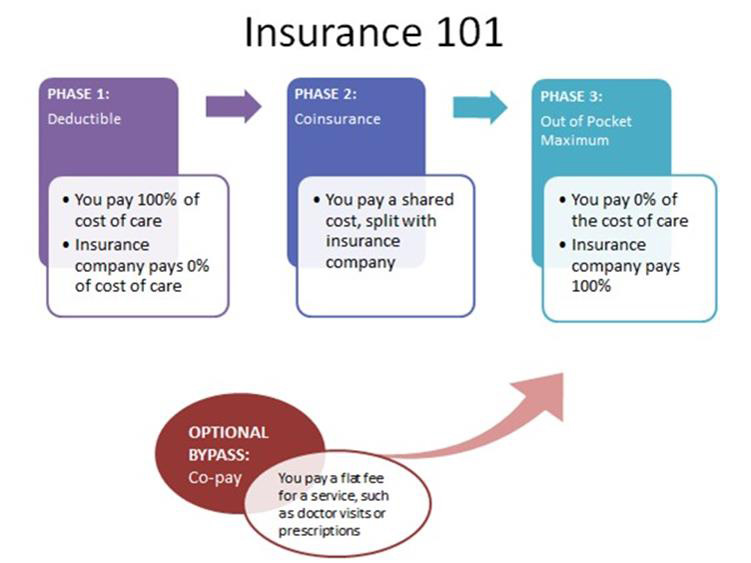

In general, insurance has 4 major parts: deductible, co-insurance, out of pocket maximum, and copay. The deductible is always the first cost to you. The deductible on your plan is the first portion of cost sharing between you and the insurance company. You pay 100% of the contracted physician rate until you reach your deductible. Once you reach your deductible, you move into “Phase 2” of insurance, the co-insurance. This is a percentage, such as 25%. Co-insurance is a sharing of costs between you and your insurance company. If your co-insurance is 25%, then you’ll pay 25% of the physician’s contracted rate, and your insurance company will take care of the remaining 75%. Most of the time, a co-insurance doesn’t last forever, it only lasts until you’ve reached your out of pocket maximum for the year. Once all of your covered medical expenses reaches a certain point, then the insurance company takes over to pay 100% of your covered medical care for the rest of the calendar year. The out of pocket max never includes your premium payments to the insurance company or charges that are either not covered or done with a non-contracted physician/facility. A copay is the 4th part of insurance. It is a flat dollar amount that you pay, generally for doctor’s visits or prescription medications, instead of having to pay the whole cost of the visit. A copay can be described as a “deductible bypass”. Your copay does not count towards your deductible, but does count towards your out of pocket maximum. Not all plans have copays as part of the insurance plan.

Contact Us so we can help you assess your needs and get you matched to the right plan!

Employee Retirement Income Security Act of 1974

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

ERISA protects the interests of employee benefit plan participants and their beneficiaries. It requires plan sponsors to provide plan information to participants. It establishes standards of conduct for plan managers and other fiduciaries. It establishes enforcement provisions to ensure that plan funds are protected and that qualifying participants receive their benefits, even if a company goes bankrupt.

Who does it protect?

ERISA covers retirement plans and welfare benefit plans. In FY 2013, ERISA encompassed roughly 684,000 retirement plans, 2.4 million health plans and 2.4 million additional welfare benefit plans. These plans cover about 141 million workers and beneficiaries and include more than $7.6 trillion in assets. About 54 percent of America’s workers earn retirement benefits on the job, and 59 percent earn health benefits.

When was it passed?

ERISA was passed by the House of Representatives on Feb. 28, passed by the Senate on March 4, and signed by President Gerald Ford on Sept. 2, 1974. It has been amended several times since in responses to the changing needs of America’s workers and their families.

Why is it important?

ERISA protects retirement savings from mismanagement and abuse, and clarifies that those in charge of those savings be held to a high standard – that is, they must act in the best interests of plan participants. It also requires transparency and accountability, ensuring that participants have access to information about their plans. More than half of America’s workers earn health benefits on the job, and ERISA protects those too, as well as other employee benefits.

How is it enforced?

ERISA is administered and enforced by three bodies: the Labor Department’s Employee Benefits Security Administration, the Treasury Department’s Internal Revenue Service, and the Pension Benefit Guaranty Corporation.

This fact sheet has been developed by the U.S. Department of Labor, Employee Benefits Security Administration, Washington, DC 20210. It will be made available in alternate formats upon request: Voice telephone: (202) 693-8664; TTY: (202) 501-3911. In addition, the information in this fact sheet constitutes a small entity compliance guide for purposes of the Small Business Regulatory Enforcement Fairness Act of 1996.