Individual Health Insurance and Colorado Insurance Broker In Fort Collins, Loveland, Greeley, Longmont, Windsor, CO, and the Surrounding Areas

Reliable Colorado Insurance Broker for Individual Health Insurance

Reliable Colorado Insurance Broker for Individual Health Insurance

Employer-sponsored benefits make group health benefits more affordable for employees, but can individual or Medicare insurance offer the same accessibility?

The individual and group insurance experts at Volk Insurance Benefits are one Colorado broker who offers solutions to this end.

Individual Health Insurance from Our Colorado Insurance Broker

Individual Health Insurance from Our Colorado Insurance Broker

People need individual health insurance coverage for many reasons. They could be self-employed, between jobs, or working at a small company that doesn’t provide employee insurance. They might even find their employer’s insurance premiums prohibitive. We will take the time to learn about your unique situation, determine whether you are eligible for any premium reductions, and match you to a plan that meets your needs.

When Can I Enroll for Health Insurance?

New health insurance or adjusting your existing coverage is only possible during year-end open enrollment. Exceptions exist for life-changing events, such as a change of location, job loss, or recent graduation. However, most people need to remain within the designated period.

- Open Enrollment – during the 4th quarter of each calendar year, typically starting on November 1st, individuals may purchase a new health insurance policy and apply for premium assistance based on their income. Policies purchased during Open Enrollment will be effective on January 1st.

- Special Enrollment Period – individuals experiencing a “Life Changing Event” during the year become eligible to purchase a plan within a 60-day window. The change must be documented and includes: loss of employer-sponsored coverage, birth, marriage, and aging off your parents’ plan. If you are experiencing a “Life Changing Event”, it is important for you to contact us as soon as possible because deadlines vary based on the event.

What is Connect for Health Colorado?

What is Connect for Health Colorado?

Connect for Health Colorado is our state Marketplace or Exchange.

CFHC gives you a place to shop for insurance from the carriers that are available in your area.

One of the benefits to using the CFHC Exchange is that if your income falls within a certain range, you may qualify for a tax credit (also called a subsidy). You can apply for the tax credit in advance, which applies towards your premium every month, or you can recapture your tax credit in the form of a refund on your tax return when you file for that tax year. Connect for Health Colorado is the only place you can shop to receive those tax credits.

If you want to have the benefit of a tax credit/subsidy, you must purchase your insurance through Connect for Health. You can purchase directly through the carrier, but you won’t have any chance of getting a tax credit, either monthly or when you file your taxes.

Subsidies/Tax credits

A tax credit is essentially money off your premium. You can choose either to take it each month or elect to take it in the form of a tax refund. There are 3 main qualifications to receive a tax credit:

- Your income must fall within a certain range

- If you’re married, you must file a joint tax return

- You are not offered any group insurance, even if you’re not enrolled in it (there are a few exceptions to this rule)

The income that the system looks at is based on your Modified Adjusted Gross Income (MAGI) that is projected for the coming tax year. For some, this is simple, as your income is the same every month. However, if your income is variable or you are self-employed, it might be slightly more difficult to project that number going forward.

CONTACT USTax Time Special Enrollment Opportunity

![]()

Check the box or ask your tax preparer

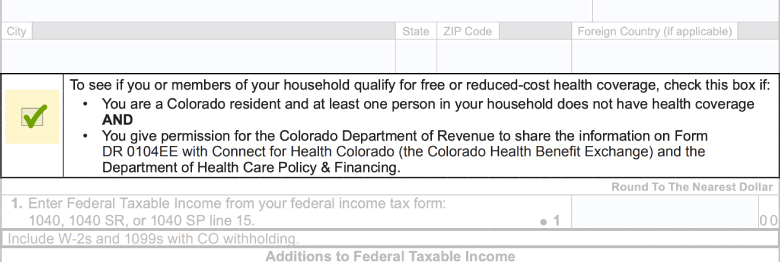

When filing your state taxes, you can check a box on Form DR 0104 to indicate that you or a family member needs health insurance and would like to find out if you can get free or low-cost health coverage.

![]()

File your taxes by the tax filing deadline

If you check the box, we will help you find out if you could get free or low-cost health coverage.

![]()

Receive an email or letter

Shortly after you file your taxes, we will send you an email or mail you a letter with information about using your Tax Time Enrollment Period.

Learn More About How Tax Time Enrollment Works

A limited chance for uninsured individuals to apply for health coverage during tax season. Learn how you may qualify and get the coverage you need

Additional Individual Health Insurance Benefits

There are other benefits available on individual policies that Volk Insurance Benefits are happy to walk you through when you want to explore your options:

Dental

A beautiful smile is an asset, but it can be expensive to maintain without dental insurance. In Colorado, there are myriad dental plans that offer different benefits.

Vision

Insurance vision benefits help individuals go for regular eye exams, keep up with eye health, afford glasses replacements with discounts, and enjoy the correct prescription lenses.

Critical Illness

Major illnesses are an enormous financial burden, even for well-insured individuals. A critical illness policy protects individuals and their families against mounting health costs so that everyone can focus on recovery.

Disability

An unexpected disability may seriously affect a family’s finances, and disability insurance provides exceptional financial security at a difficult and stressful time.

Accident Policy

Accidents can happen to anybody, and related policies help pay for unexpected injury-related expenses, including lost wages.

Life Insurance

Life insurance provides your loved ones with anything from funeral expenses to years of financial security, depending on the policy.

International Travel

If medical emergencies happen to Americans abroad, regular health insurance policies will not be of much help. Bills mount quickly and getting home sometimes becomes challenging. A small amount of money will give travelers insurance that will cover medical treatment and repatriation expenses for peace of mind.

American Rescue Plan Act (ARPA) Info

The government has introduced emergency responses to financial difficulties through the American Rescue Plan Act. It includes subsidies for individuals buying health and dental insurance coverage. If your business does not offer group health insurance or small business health insurance as part of an employee benefits package, the only medical insurance option left might be individual coverage or these emergency options.

ARPA FAQs